If you borrowed against the equity in your home, chances are your mortgage contains one or more errors. The Lane Law Firm can help you determine what violations you have and how to fix them - just as we've done for more than a thousand clients since 2009.

Texas has traditionally had very strong state laws to protect homeowners. In fact, the state didn't even allow homeowners to borrow against the equity in their homes through Home Equity or HELOC (Home Equity Line of Credit) Loans until 1998.

Since then, hundreds of thousands of Texans have borrowed against the equity in their homes to finance home improvements, consolidate debt, pay for college, or whatever else they wanted to do with the proceeds. They did so with the assurance that they were protected by the most homeowner-friendly protections in the nation. But since then, banks have lobbied hard to water down those protections with various amendments that benefit themselves over homeowners. Read about how Home Equity borrowing in Texas forever changed on January 1, 2018.

Surprisingly, most Home Equity Loans prior to 2018 do not comply with the strict consumer protections that were initially written into the Texas Constitution. In fact, since 2010 we've examined thousands of loans (at no cost to our clients) and discovered that about 87% of them contain one or more violations!

When violations are brought to the attention of the bank, the law requires they "cure" or fix all violations. Legally, they are given fair opportunity to "make things right" with minimal consequence to them.

Sometimes they do the right thing and make the borrower whole, but often times they refuse to do so - ignoring their legal obligation. In these instances, you, as the borrower, may be entitled to cash compensation and/or your lender may be required to return all your payments and void your lien so that you own your home without owing anything on your mortgage!

Even if you took out the loan several years ago, you still have time to examine your loan documents to see if you too are the victim of fraud, predatory lending, or illegal loan practices that are common with these loans.

If you aren't sure if your loan contains errors, take advantage of the resources on this page to discover for yourself if your loan is one of the 87% that contains errors. If you have questions, call our friendly staff at 713-590-3066 for a no cost or obligation consultation, or click here to schedule a meeting with us at your convenience.

We're happy to perform a comprehensive audit of your loan documents without cost or obligation, so what do you have to lose?

We are pleased to assist clients with select services on a contingent fee basis, meaning that if the firm does not obtain a recovery, or if the amount recovered does not exceed the amount of costs and expenses, then the firm is not entitled to any fees.

The first step in determining if you were the victim of an illegal loan is to locate your loan documents. What you are looking for is the set of documents that you received upon signing for your loan. The document set may be in a folder or envelope with a title company's logo on it.

The document set includes a Settlement Statement, a Texas Home Equity Note, a General Warranty Deed, a Texas Home Equity Security Instrument or Deed of Trust, an Acknowledgment as to Fair Market Value of Homestead Property, and other miscellaneous documents. If you've refinanced you loan, then find the documents associated with the most recent loan.

If you are unable to locate your loan documents, contact the title company who processed your closing and they should be able to provide copies at no cost to you. If you didn't receive copies, that is a violation. If you did not go through a title company, you likely have an illegal loan!

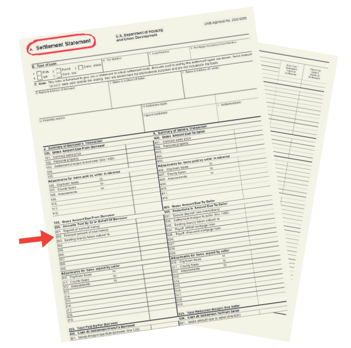

Now that you've found your loan documents, look for your Settlement Statement. It is a standard form used to itemize actual settlement costs. The words "Settlement Statement" will appear at the top of the document that looks like a chart with four columns. It is typically on legal-sized paper and looks similar to the image below.

First: Find the Principal Amount of New Loan(s) on line 202. Multiply the amount that appears in line 202 by 3%. (For example, if the Principal Amount of New Loan(s) is $100,000, 3% of $100,000 = $3,000). This is the maximum amount you can be charged in fees.

Then: Add up any and all fees paid by adding all the figures in the Borrower’s (left) column on Page 2 of the Settlement Statement.

These fees include:

|

|

Finally: If the total of fees are greater than 3% of the loan, you likely were charged too much in fees, making your loan illegal. Skip to Step 5 to see how to fix the problem, or continue on to Step 3 to see if your loan has additional violations.

The Acknowledgement of Fair Market Value is a required document that provides the fair market value as determined by the lender on the day the loan was given. Click here to see sample documents with missing signatures.

First: Is the document signed and notarized by all parties, including the lender? If not, your loan is likely illegal. Skip to Step 5 or continue looking for violations.

Then: Find the “fair market value” dollar amount on the Acknowledgement of Fair Market Value document. Multiply the amount by 80% to determine the maximum loan amount. (For example, if the Fair Market Value is $100,000, 80% = $80,000).

Finally: Find the Principal Amount of New Loan(s) on line 202 of the Settlement Statement (from Step 2). Add this to the balance of all other loans attached to the home (if any). Referring to our previous example, if the sum is greater than the Fair Market Value which was $80,000 in this case, you likely were loaned too much, which would make your loan illegal.

Skip to Step 5 or continue looking for more violations.

Not sure about what the fair market value is?

Call the experts at The Lane Law Firm at 877-408-3328 or click here to schedule an appointment – they’ll guide you through the calculations, or examine your documents for violations for you at no cost, and without any obligation.

In addition to the common violations in Steps 2 & 3, the Texas Constitution provides many additional requirements that lenders must adhere to. But so often in their haste and greed to lend money, they fail to follow the legal requirements.

Some additional violations include:

If you answered "yes" to any of these items, you likely have an illegal loan. By law, the bank must correct any violations. Keep reading to find out how...

Not sure if you have any violations?

Not sure if you have any violations?

Call the experts at The Lane Law Firm at 877-408-3328 or click here to schedule an appointment – they’ll examine your documents for violations for you at no cost, and without any obligation.

So you’ve determined that you likely have an illegal loan. In order to have the violations corrected, you must notify the bank by sending a Demand Letter requiring that they correct the error(s). The bank then has 60 days to “cure” the violations by paying you a fine of $1,000 and correcting the exact violation(s) by refunding money and/or re-closing the loan.

First: Compose a well-written, typed or hand-written demand letter to your current mortgage servicer. You should include the following:

1. The full name of all borrowers on the loan

2. The last four digits of all borrower’s social security number

3. Your property address

4. The full loan number

5. Specify the violation(s) you found in your Home-Equity Loan

6. Demand that the mortgage company cure the listed violation(s)

7. Notify lender that they must comply to your demand within 60 days

Then: If the bank ignores your Demand Letter or claims they didn’t do anything wrong, you must file a lawsuit to enforce your rights. You can do this pro se, meaning you represent yourself, or you can hire a lawyer to draft the petition and negotiate on your behalf.

You should only consider lawyers with expertise in Home Equity Loans and who have experience in litigating (and winning) hundreds of similar cases in Texas.

Check with the State Bar of Texas and on-line attorney rating services such as Avvo. The Lane Law Firm specializes in Home Equity lawsuits and can represent you and your Home Equity violation case completely on contingency in most cases. To schedule your no cost, no obligation appointment, click here or call 713-590-3066.

On November 7, 2017 Texans passed Texas Proposition 2, also known as SJR 60 or the Home Equity Loan Amendment (2017). It made changes to Section 50(a) of Article 16 of the Texas Constitution, and became effective January 1, 2018.

Key changes to the law include:

Home equity loans that originate after January 1st of 2018 will be impacted, as well as loans made prior to the change that are refinanced after January 1st. For more information on the impact of the change, read How Home Equity Borrowing in Texas has Forever Changed.

Privacy Policy and Terms of Use.

In the event a client should choose bankruptcy and seek our help to file under the United States Bankruptcy Code, The Lane Law Firm would be considered a debt relief firm. We are not licensed by the Texas Board of Legal Specialization. Use of this website does not constitute legal advice and does not establish an attorney-client relationship. None of this content may be used without express written consent. Images are not intended to portray actual clients; they are for navigational purposes only. Principal Office: 6200 Savoy Dr. Ste 1150, Houston, TX 77036