How Does a Property Insurance Case Get Settled?

The Lane Law Firm | Nov 14, 2025

Understanding How Your Property Insurance Case Gets Settled

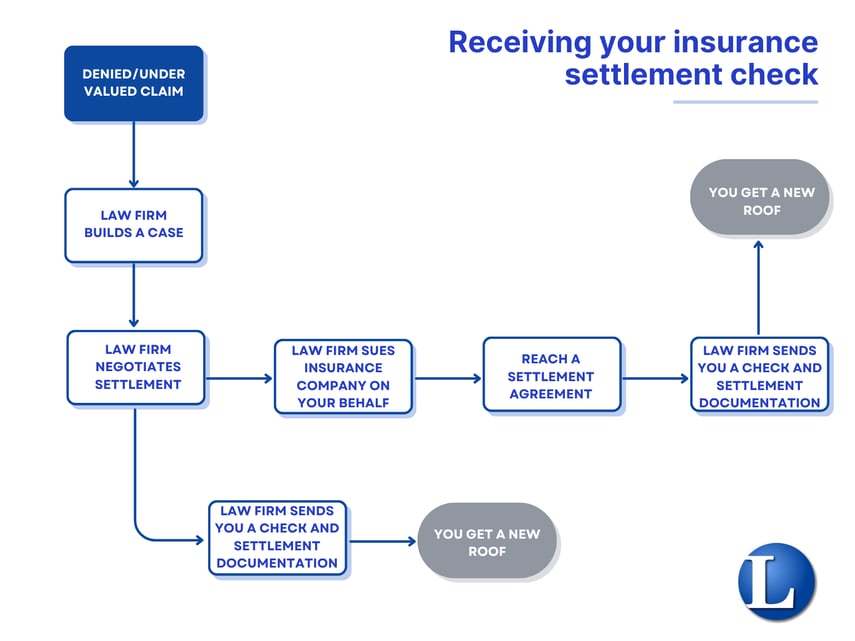

When your property insurance claim is denied or you receive an underpaid insurance payout, it can feel like the process is over, but it’s just getting started.

With help from an experienced insurance attorney, you can challenge your insurer’s decision and pursue the full compensation you deserve. From a denied homeowners insurance claim to receiving a fair settlement, here’s how the property insurance case settlement process works from start to finish.

1. Denied or Underpaid Claim

The property insurance case settlement process often begins when your insurer denies your claim or offers a payout that doesn’t cover your full damages. This is common after roof damage, water leaks, or severe storms. When your claim is denied or underpaid, this is where an experienced insurance attorney steps in to review your policy, assess your losses, and determine if your insurer acted in bad faith.

2. Law Firm Builds Your Case

Once you hire an attorney, their team begins gathering evidence, reviewing your insurance policy, documenting damages, and obtaining repair estimates. This ensures your case is fully supported and positions you for a successful outcome in the property insurance case settlement process.

3. Negotiating a Settlement

The next step in the insurance case settlement process is negotiation. During negotiations, your attorney will present documentation, estimates, and expert opinions to demonstrate the true value of your losses. The goal is to secure a fair and timely settlement without needing to go to court.

4. Filing a Lawsuit

If the insurance company refuses to make a fair settlement offer or doesn't make one at all, your attorney may move forward with filing a lawsuit on your behalf.

Insurance companies may refuse to settle for several reasons, including:

- The homeowner previously received payment for roof repairs but didn’t complete the work.

- The prior homeowner received an insurance payout for roof damage but didn’t use it for repairs (this issue can still be challenged in court).

- The insurer claims the roof damage resulted from normal wear and tear, mechanical issues, fraud, or that no damage exists.

It's important to note that the length of the settlement process after filing suit depends on many factors, such as the insurance company’s response time and the details of your original claim communications.

5. Receiving Your Insurance Settlement Check

Once a settlement is reached through negotiation or court, your insurance company sends the check to your attorney. Your attorney will ensure the insurance payout is correct and will send you the check. This confirms your funds are ready to use for home repairs, completing the final steps of the property insurance case settlement process.

6. You Get a New Roof

Finally, you can put your settlement funds to work, whether that means replacing your roof, repairing storm damage, or rebuilding part of your home.

Why Work With an Insurance Attorney?

The home insurance case settlement process can feel overwhelming, but with an experienced attorney guiding you, you’ll understand every step. Whether your claim settles early or goes to court, The Lane Law Firm is here to help Texas homeowners get the full compensation they deserve.